Introduction

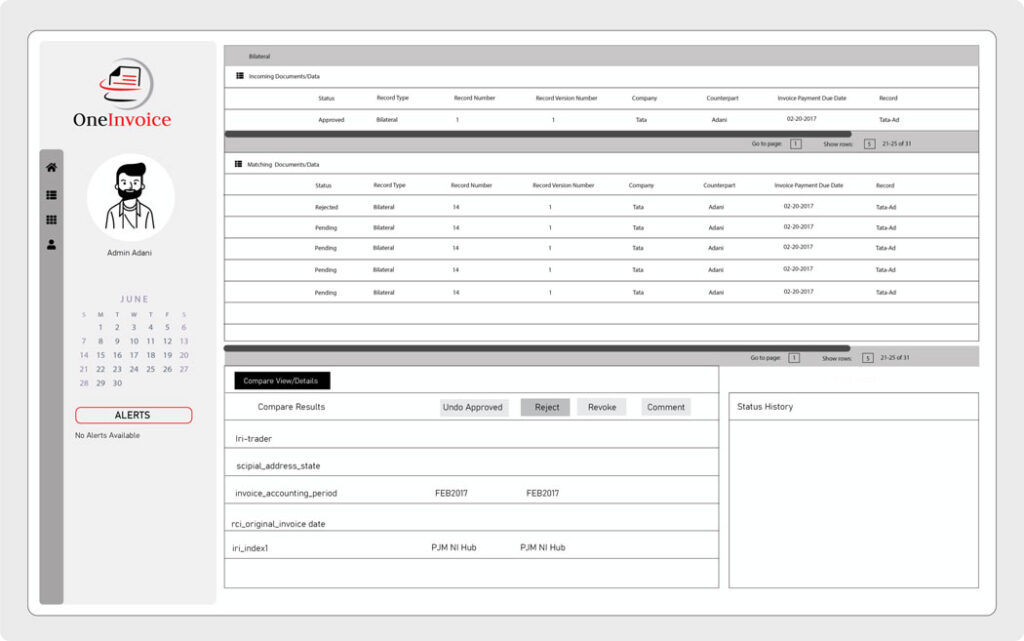

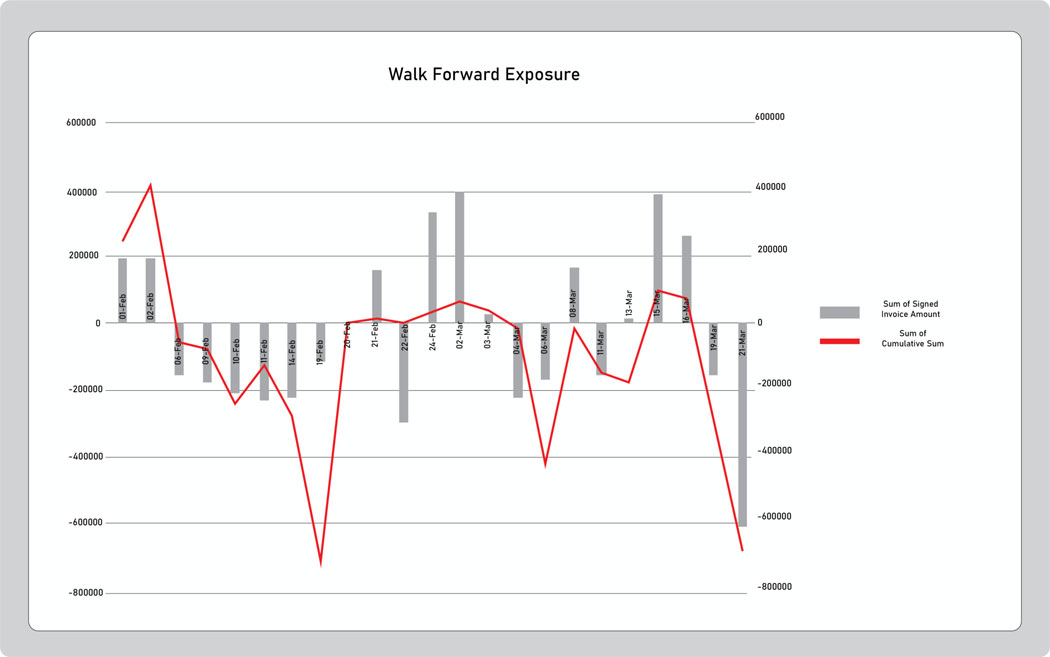

Invoices and Settlements remain one of the most manual and labor-intensive process in commodities and broader financial trading industry. The quantum of data makes the invoices and corresponding reconciliation a nightmare.

Faxes and documents (paper) via email remain the primary channel for exchanging invoices to Counterparts, Brokers/Clients, Agents, and Farmers. Though automation has been adopted in some internal tasks of reconciliation, the data exchange remains highly manual and paper based.

Data Driven and Digital Commodities has taken forefront role in commodities technology.

Manual and Paper based Invoice Management can lead to:

- Longer Processing Times (using combination of electronic and manual steps)

- Increased Human Error/Costs

- Faulty Communication leading to unintended delays

- Lack of Auditability/Compliance

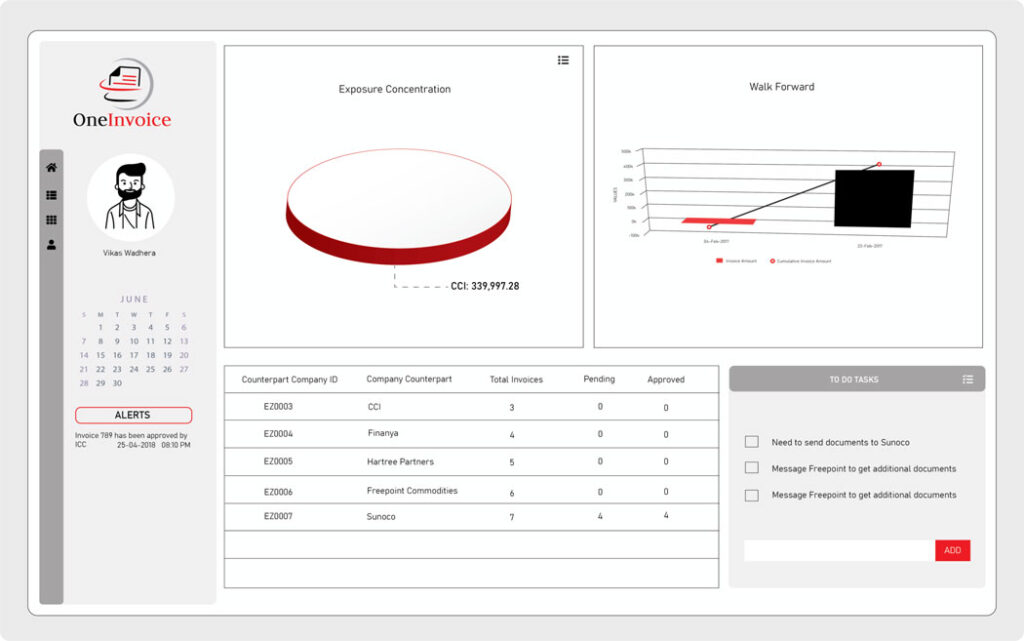

“OneInvoice allows counterparts to use data driven platform to exchange and approve invoices accurately and faster. As a result, we can shorten the Payment Terms up to t+3 or even t+0 instead of currently prevalent longer terms” – Vikas Wadhera, Founder, OneCore global.

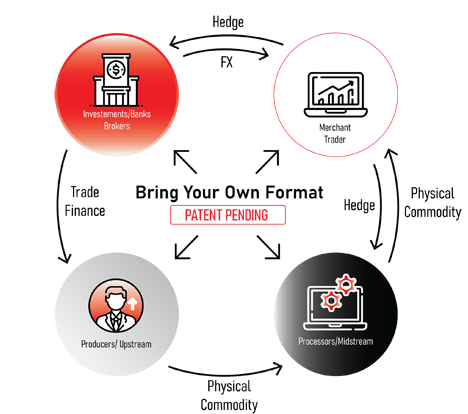

OneInvoice provides utilizes our patent-pending technology which allows for managing multiple data formats/sets based on Counterpart, Commodity, Instrument Traded, Region or other attributes. Data Granularity can be set based on market needs such as Hourly or Sub-Hourly for Power/Gas.